Estate planning isn’t just for the wealthy or the elderly. It’s something every adult should consider, no matter their age, family size, or financial situation. Having a plan in place ensures your loved ones are cared for and your wishes are respected.

If you’ve been putting it off, you’re not alone. Many Australians delay estate planning because it feels daunting or unnecessary. But with the right guidance, it’s simpler than you might think.

What is Estate Planning?

Estate planning is the process of legally outlining how your assets, responsibilities, and wishes will be managed if you pass away or become unable to make decisions yourself.

It’s more than just a will. A comprehensive plan can cover:

- Who inherits your property, savings, and valuables?

- Guardianship for your children.

- Directions for medical care if you’re unable to speak for yourself.

- Who has the authority to make financial decisions on your behalf?

Why Estate Planning Matters

1. Peace of Mind

Estate planning removes uncertainty for your loved ones. Without a valid will, the law decides how your estate is divided, and this may not reflect your wishes.

2. Protecting Your Family

If you have children, you can name guardians who will look after them. This avoids stressful court disputes and ensures your children are cared for by the people you trust.

3. Avoiding Disputes

Clear instructions can reduce the risk of family conflicts. Disagreements over inheritance are unfortunately common, and estate planning helps prevent them.

4. Managing Complex Assets

From property investments to small businesses, estate planning ensures assets are distributed smoothly and efficiently.

The Core Elements of Estate Planning

Estate planning can feel complex, but breaking it down into steps makes it easier.

Writing a Legally Valid Will

A will is the foundation of any estate plan. It specifies how your assets should be divided and who should manage your estate. Without one, intestacy laws apply, which may leave loved ones without the support you intended.

Appointing an Executor

An executor is the person responsible for carrying out your wishes. Choosing someone reliable and organised is critical.

Power of Attorney

A power of attorney allows someone you trust to make financial or legal decisions on your behalf if you’re unable to do so.

Advance Care Directive

This sets out your preferences for medical treatment and end-of-life care. It ensures your wishes

are honoured, even if you can’t communicate them.

Common Misconceptions About Estate Planning

Estate planning is often misunderstood. Let’s debunk a few myths:

“I’m too young to need a will.”

Accidents and illnesses can happen unexpectedly. Having a plan ensures your loved ones are protected at any age.

“My family will sort it out.”

Even the closest families can face conflict when legal matters arise. A will provides clarity.

“Estate planning is only for the wealthy.”

Whether you own a home, have savings, or personal belongings with sentimental value, estate planning ensures they’re passed on as you wish.

How to Start Your Estate Planning Journey

Step 1: Take Stock of Your Assets

Make a list of your property, bank accounts, investments, superannuation, and valuables.

Step 2: Consider Your Beneficiaries

Think about who you’d like to inherit your estate and in what proportions.

Step 3: Choose Guardians and Executors

If you have dependants, decide who should care for them. Also, select someone trustworthy to administer your estate.

Step 4: Seek Professional Guidance

DIY wills can be risky. Mistakes or unclear language may leave your estate open to legal challenges. Speaking with Estate Planning Lawyers Melbourne ensures your documents are valid, enforceable, and tailored to your circumstances.

The Benefits of Professional Guidance

Engaging a lawyer for estate planning isn’t just about paperwork—it’s about protection. Lawyers can:

- Ensure your will complies with Victorian law.

- Help you structure your estate to minimise tax implications.

- Update your documents as your life circumstances change.

- Provide strategies to safeguard assets from potential disputes.

When Should You Review Your Estate Plan?

Life changes, and so should your estate plan. Review it when you:

- Get married, divorced, or enter a new relationship.

- Have children or grandchildren.

- Buy or sell property.

- Start or close a business.

- Experience significant changes in your financial situation.

Conclusion

Estate planning isn’t about anticipating the worst; it’s about protecting the people you love and ensuring your legacy lives on. A valid will and supporting documents provide clarity, security, and peace of mind.

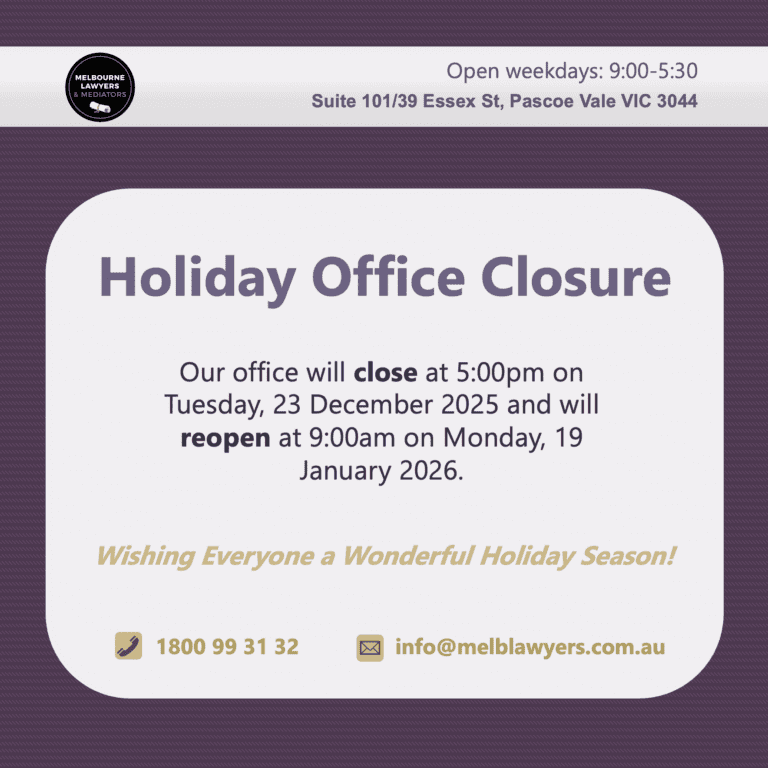

Don’t wait until tomorrow to make these decisions. By taking action today, you’ll save your loved ones stress and uncertainty in the future. For supportive, professional guidance tailored to your needs, you can reach out to Melbourne Lawyers & Mediators.